What is Form 1099-MISC?

Form 1099-MISC is used to report miscellaneous income received during the tax year. It is used to report rent, fishing boat proceeds, medical and health care payments, prizes, awards, and more. A copy of the 1099 Form must be furnished to the recipient before the deadline.

Visit https://www.taxbandits.com/1099-forms/what-is-form-1099-misc/ to know more about Form 1099-MISC

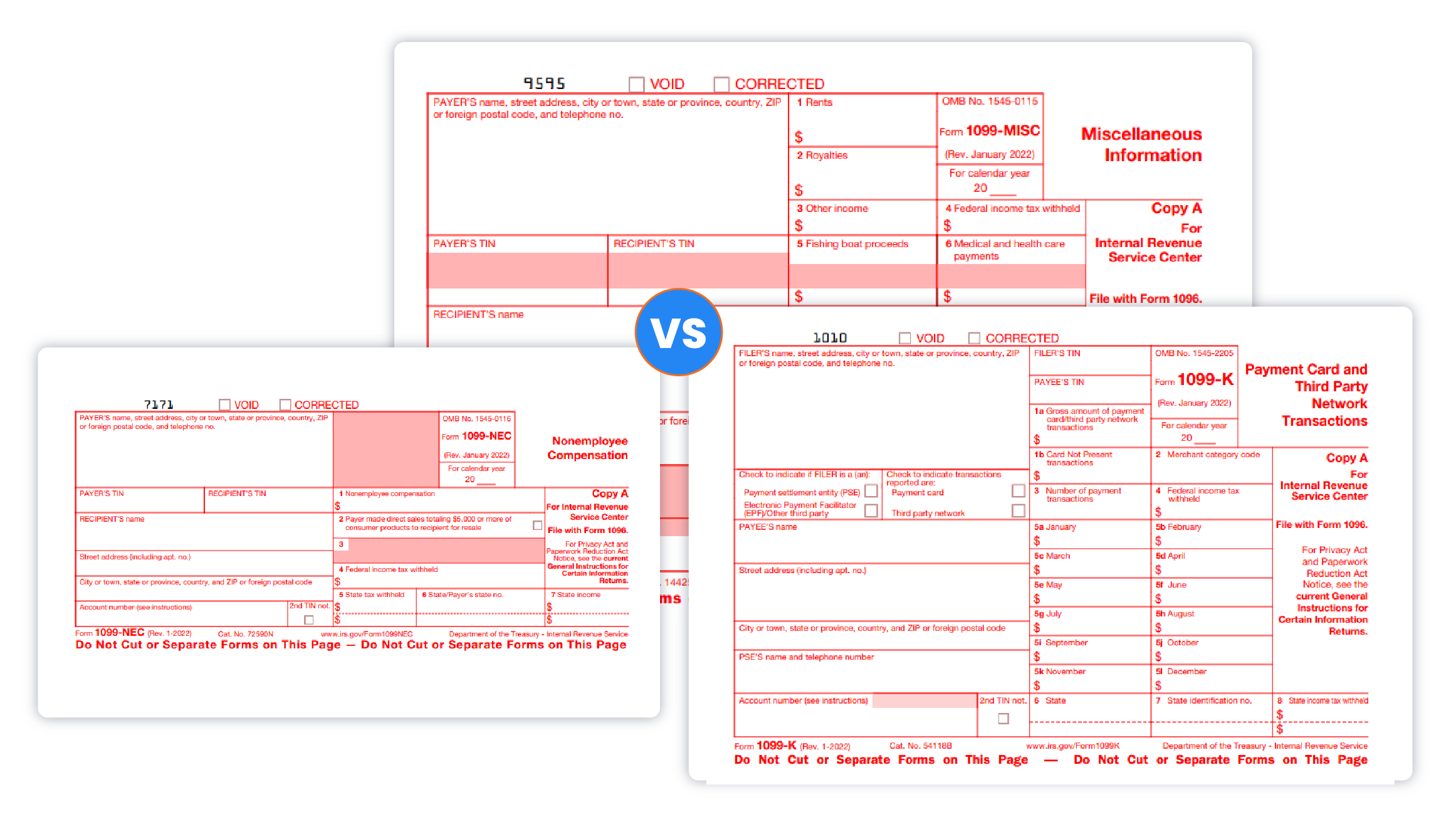

What is the difference between Form 1099-K vs 1099-NEC vs

1099 MISC?

The major difference between Form 1099-K vs 1099-NEC vs 1099-MISC is the type of payment on each form. The Form 1099-K includes payments via payment cards like debit, credit, and stored value cards and third-party networks like payment apps and online marketplaces. On the other hand, Form 1099-NEC and MISC include payments made via ACH transfers, cash, or traditional checks.

Payment settlement entities File 1099-K , while businesses and individuals file Forms 1099-NEC and 1099-MISC.

Due Dates for filing IRS 1099-Miscellaneous Form for 2023

31, 2024

28, 2024

01, 2024

Note* The due date is extended to February 15, 2024, if you are reporting payments in boxes 8 or 10.

E-file your Form 1099-MISC before the deadline to avoid penalties.

Easily Import your data from Accounting Software

XERO

Our Xero 1099 Integrationprovides a convenient and secure way to swiftly import your vendors who are eligible for 1099 reporting, along with their payment information.

QuickBooks

Additionally, we provide QuickBooks 1099 Integration ,enabling seamless synchronization of your vendor and payment data from QuickBooks with our software.

ZohoBooks

We support Zoho Books 1099 integration making it simple and secure to import your Zoho Books data with our software for efficient e-filing of Form 1099.

FreshBooks

Additionally, we provide support for FreshBooks 1099 Integration ,enabling you to effortlessly and securely integrate your data from FreshBooks.

E-Filing Partner

Sage Intacct 1099 Integration

We have partnered with Sage Intacct 1099 to offer a direct and smooth integration, enabling Sage Intacct users to easily and promptly e-file Form 1099 from their Sage account, without any hassle.

What are the Filing methods for Form 1099-MISC

Paper Filing of 1099-Miscellaneous Form

1099 Miscellaneous Form paper filing is otherwise the manual filing method of your information return forms to the IRS. While paper filing your

1099-MISC form there is a need to submit Form 1096 as it becomes the transmittal proof. Being a physical method this filing would

take a longer time.

E-Filing of 1099-Miscellaneous Form

An alternate method to report 1099-MISC Forms is filing it electronically to the IRS. Electronic filing is the most recommended method by the IRS and it takes only a few minutes to complete and transmit your returns.

Visit

https://www.taxbandits.com/1099-forms/efile-form-1099-misc-online/ to know more about the filing of IRS 1099-MISC Form.

Advantages of E-filing

- Greater Accuracy

- Avoid paper works & filing errors

- Filing done within few minutes

- Safe and Secured method to File your 1099 forms

- Form 1096 gets generated automatically

- Transmitted copies are accessible anytime and anywhere

Information Required To Complete IRS Form 1099-MISC

In order to complete Form 1099-MISC you need to provide the following information:

- Payer Details: Name, EIN, and Address

- Recipient Details: Name, EIN/SSN, and Address

- Federal Details: Miscellaneous Incomes and Federal Taxes Withheld

- State Filing Details: State Income, Payer State Number, and State Taxes Withheld

Why 1099-miscellaneous.com is the #1 E-Filing Solution?

We have taken the time to provide a safe and secure program that will help you to e-file 1099-MISC Forms in a matter of minutes. Our helpful e-filing guide explains exactly how to e-file and what information is required to complete the form. Plus our features for bulk uploading information, postal mailing, and more make the entire process incredibly convenient.

Your state may require you to File Form 1099-MISC and provide additional information! IRS will forward your information to the state department. However, some states still require you to file.

Steps to E-File IRS Form 1099-Misc

Filing Form 1099-MISC is a quick and easy process! Just refer to the following instructions:

-

Step 1: Create your new account with your email address and personal password. Then select 'New 1099-MISC Form'

Step 1: Create your new account with your email address and personal password. Then select 'New 1099-MISC Form'

-

Step 2: Enter the payer details, including the name, EIN, and address.

Step 2: Enter the payer details, including the name, EIN, and address.

-

Step 3: Enter the recipient details, including the name, EIN/SSN, and address.

Step 3: Enter the recipient details, including the name, EIN/SSN, and address.

-

Step 4: Enter the federal detail for the miscellaneous income. Also, enter the state information and state taxes withheld for each eligible state.

Step 4: Enter the federal detail for the miscellaneous income. Also, enter the state information and state taxes withheld for each eligible state.

-

Step 5: Then simply review your form, pay for it, and transmit it directly to the IRS.

Step 5: Then simply review your form, pay for it, and transmit it directly to the IRS.

Other Supported 1099 Forms

Form 1099-MISC Penalties

The IRS will issue penalties for not filing 1099-MISC Forms. If filing a 1099 MISC Form that is late for 30 days or less, the penalty is $60 per form and increases to $120 per form if more than

30 days late.

Form 1099-MISC Extension

If you need more time to file your Form 1099-MISC simply file Form 8809. By filing this extension form you will automatically receive a 30-day extension to e-file Form 1099-MISC! Imagine what you could do with 30 extra days to file.

Form W-9: Request for Taxpayer Identification Number and Certification

Invite your vendors to complete and e-sign W-9

Form W-9 is an IRS tax form used by an individual or entity to request a person's name, address, Taxpayer Identification Number (TIN) and certification from a hired contractor or vendor to e-file the 1099 information returns. IRS Form W9 is known as Request For Taxpayers Identification Number and Certification Form.

With TaxBandits online portal, employers can request w9 form online and manage all W-9 forms at one place securely. Sign up now and request the first FIVE Form W-9 for FREE.